- Home

- /

- Teaching Staff

- /

- ACM Payment for Teachers

Guidance on One-off exceptional £400 payment for Teachers supporting the delivery of the Alternative Certification Model for National 5, Higher and Advanced Higher qualifications in 2020/2021

On 8 December 2020, in acknowledgement of the additional workload of national qualifications assessment in the absence of 2021 exams, John Swinney, the former Cabinet Secretary for Education and Skills, announced an exceptional one-off payment for teachers and lecturers to support delivery of the Alternative Certification Model (ACM) that is replacing National 5, Higher and Advanced Higher exams in session 2020/21.

This guidance is for education authorities, school headteachers, the proprietors of independent schools and the managers of grant-aided schools who employ teachers supporting the delivery of National 5, Higher and Advanced Higher courses in school year 2020/2021. Separate guidance is being produced for colleges.

1. Payment Form submission and completion

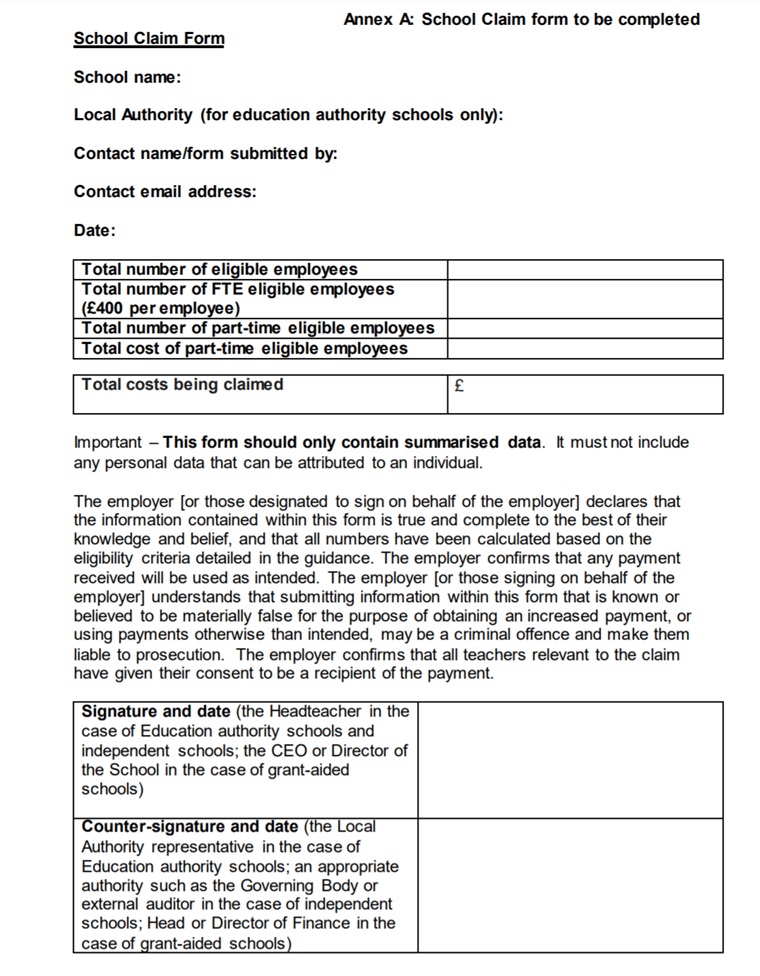

1.1 Education authority schools, independent schools and grant-aided schools should complete the form provided at Annex A for eligible teachers. Staff will receive the taxable payment of up to £400. A single form should be completed:

a. By each local authority for each of their schools;

b. by managers of grant-aided schools and

c. by proprietors of independent schools for the schools that they operate.

1.2 This will be paid through a grant arrangement to education authorities and directly from the Scottish Government through a grant to independent and grant-aided schools. Employer National Insurance contributions (NICs) on the payment will be paid.

1.3 The vast majority of this work will be completed prior to the end of the school year. Provisional grades for learners require to be determined by 25 June 2021. There is also a limited further window which may come into scope in August/September for teachers supporting learners who have experienced severe disruption – for example by medical conditions, bereavement, self-isolation, or shielding – and have not been able to complete all their evidence by the end of term1. They have been given the additional discretion to complete their assessments by 3 September 2021. This may require two forms to be completed to cover the period up to 25 June and, where relevant, a further return for the period in the new school year up to 3 September 2021.

1.4 Completed forms should be submitted to teacherpayment400@gov.scot by 30 September 2021. The Scottish Government recognise that institutions may wish to ensure timely payment to employees and can therefore submit two forms to cover the two separate qualifying periods.

2. Payments

2.1 Once the form has been submitted and approved by the Scottish Government, a payment will be made to the relevant employer to allow the

employer to make payment to staff following completion of the work in relation to the ACM.

2.2 Payments should be made to staff through normal payroll to ensure income tax and national insurance are correct, and to facilitate notification to DWP and Social Security Scotland where relevant.

2.3 The relevant employer institution will be required to satisfy itself in line with its governance arrangements of the veracity of the claims being made and may wish to consider evidence of individual teacher claims to support audit requirements.

3. Timetable

Payment form goes live Mid-June 2021

Deadline for forms submission 30 September 2021

Completion of the ACM work Two periods: by 25 June 2021 and by 3 September 2021. A return in September will only be relevant if additional

teachers, not previously involved, qualify for payments.

3.1 Please note that we are asking employers to contact their staff as soon as possible to provide them with information about the payment. A standard form of words is provided at section 15. This also seeks responses from staff who have concerns about receiving the payment and who have since left or retired.

3.2 Staff who have concerns about the potential impact on their benefits are advised to seek advice. Employers are encouraged to work with these staff to consider options, for example taking the payment in instalments up to 3 months, in order to minimise the impact on benefits. We may ask you for total numbers who have notified you of concerns and where necessary discuss with you potential alternative approaches to the payment.

4. Eligibility

4.1 Employers should complete and submit the form for the one-off £400 pro rata payment for teachers and lecturers employed in education authority schools, independent schools and grant-aided school, who have supported the delivery of one or more of the following functions: assessing, marking or quality assuring National 5, Higher or Advanced Higher courses in academic session 2020/2021, and who were employed between 1 January 2021 and 25 June 2021 for the initial window and, where relevant, between the start of the new school year in August and 3 September 2021; these are the qualifying periods. References to supporting the delivery of the ACM in the rest of the guidance are intended as short-hand for this eligibility criteria.

4.2 Those who work full-time or part-time and are subject to a permanent or temporary contract are eligible.

4.3 Those who were shielding; on sick leave; on maternity, paternity, adoption leave; or furloughed are not precluded from qualifying for this payment if they have had a role in supporting the delivery of the ACM. Those who have since left or retired are also eligible.

4.4 This is a one-off exceptional payment in recognition of the additional workload for teachers and lecturers who will have supported the delivery of the ACM in the unique circumstances brought about by the Covid-19 pandemic.

5. Payment Calculations

5.1 The payment is capped at £400 per person and will not exceed this amount.

5.2 For eligible staff, the payment will be based on average contracted hours and reflect the degree to which the employee’s individual work has supported the delivery of the ACM. This will require a judgement on the part of the headteacher: the notes below set out guidance on how to arrive at this judgement.

Full-time staff definition

5.3 Any member of staff who worked full time hours as defined by their employer and is eligible based on the criteria above should be counted as 1 FTE and receive £400, subject to the paragraph on multiple employers below.

Part-time staff definition

5.4 The calculation for part-time staff is based on a judgement taking into consideration their average contracted hours worked over the qualifying

period as a percentage of a full time week and the degree to which delivering the ACM has had a disproportionate effect on their workload in comparison to the average additional workload of their full-time colleagues. Where this is the case, headteachers have the flexibility to consider any payment above the pro rata equivalent based on their contracted hours, up to a maximum of £400.

5.5 For example, in the case of an individual teacher working 0.5 FTE, a pro rata payment would be £200. However, in instances where an individual teacher has been required to spend a greater proportion of their time supporting delivery of the ACM when compared to the average full-time teacher, the Scottish Government will accept a request for a higher level of payment up to £400.

5.6 The rationale behind this approach is set out in the Equality Impact Assessment, but seeks to provide greater equality of approach in recognising

all those teachers who have supported delivery of the ACM, being mindful of the individual teacher variations in terms of workload. There is headteacher discretion to enable them to avoid the potential disparities at a local level in terms of proportion of work associated with delivering the ACM for part-time workers, in comparison with their full-time colleagues, which can be reflected in the payment claimed.

Multiple Employers

5.7 Employers should notify staff that it is their responsibility to make sure that, when they have more than 1 employer, the maximum payable will be £400 in total. A standard form of words for staff is provided at section 15 below.

5.8 If a member of staff works for more than 1 employer, they should notify one of their employers and ask for their payment to be reduced or disregarded from that employer.

5.9 Where the employer is aware that an employee works for more than one establishment and the employee has not separately notified them of this for the purpose of the payment, the establishment must confirm with the employee that they have notified the other establishment, and where possible, verify this with the other establishment. The Scottish Government may carry out a cross-check once returns have been received to assure itself of the veracity of the claims.

6. Leave and sickness

6.1 Those who were shielding; on sick leave; on maternity, paternity, adoption leave; or furloughed are not precluded from qualifying for this payment if they have had a role in supporting the delivery of the ACM.

7. Leavers

7.1 Staff who have since left or retired but who were employed between 1 January 2021 and 25 June 2021 are eligible – they would be expected to

contact their former employer with any queries directly.

7.2 If a member of staff has been summarily dismissed (instant dismissal for gross misconduct) they are not eligible to receive the payment and should not be included in payment numbers submitted. If a dismissed employee has their dismissal overturned or found to be unfair they will be eligible to receive the payment.

8. Tax and benefits

8.1 These payments made to staff are regarded as earnings and will be liable for tax, national insurance contributions, student loan repayments, and tax credits, where appropriate.

8.2 The payment is considered as “non-consolidated”. Therefore it is not pensionable and does not create a new baseline for future pay calculations.

8.3 13.8% will be added to each payment for employer National Insurance contributions (NICs).

8.4 Anyone in receipt of benefits should seek advice. Important information for staff in receipt of benefits is provided in the standard form of words for communication to staff in section 15.

9. Complaints process

9.1 The payment is being paid in recognition of the specific additional burden associated with delivering the ACM and is being paid by your employer on behalf of the Scottish Government. The payments are made in accordance with the eligibility criteria set by the Scottish Government. If you are unhappy with the initial determination on the payment your employer will be able to provide the grounds on which the payment has been determined, including the relevant aspects of this guidance.

How to complain: frontline resolution

9.2 If you are still dissatisfied with the initial explanation on the £400 payment, please contact the Scottish Government. They will work with you to resolve it.

9.3 Any issues that arise should be reported to teacherpayment400@gov.scot for resolution.

9.4 The Scottish Government aim to resolve your complaint informally within five working days. If they can’t resolve the issue, you can take your complaint to stage two of the complaints procedure.

If you are not satisfied: Investigation

email: sgcomplaints@gov.scot

write to Scottish Government, Complaints, 1E.10, St Andrew’s House, Edinburgh, EH1 3DG

9.5 An Investigating Officer will be appointed to prepare a comprehensive report and, if we have got things wrong, will recommend improvements. We will:

acknowledge receipt of your complaint within three working days;

where appropriate, discuss the complaint with you to understand why you remain dissatisfied and what outcome you are looking for;

give you a full response as soon as possible and within 20 working days. We will tell you if our investigation will take longer and will agree revised

time limits with you and

If, after we have fully investigated, you remain dissatisfied, you then have the option of asking the Scottish Public Service Ombudsman (SPSO) to

investigate your complaint.

Independent investigation of your complaint: Ombudsman

9.6 The Scottish Public Services Ombudsman (SPSO) is the final stage for complaints about public services in Scotland and may be able to

independently take up a complaint on your behalf. The Ombudsman will normally only be able to act if you have followed the steps above.

9.7 To find out about the Ombudsman’s work, visit the Scottish Public Services Ombudsman website, or write to the office at: Freepost SPSO (this is all you need write on the envelope, and you do not need to use a stamp).

10. Evidence required

10.1 The form, provided at Annex A, will ask you for all the information that is required to be submitted in order to receive payment. However, because this is a new process we may request some more information in order to validate the payment. The Scottish Government (SG) may ask for additional supporting evidence to validate the claim (prior to, or after a claim is paid).

11. Recovery of Payment due to fraud or error

11.1 The Scottish Ministers may re-assess, vary, make a deduction from, withhold, or require immediate repayment of the payment or any part of it in the event of fraud or through an identified error.

11.2 The Scottish Government and employers must make all reasonable effort to ensure that all eligible staff receive the payment as quickly as possible, subject to returns being received timeously. Those completing the claim form should ensure that all the information they provide is true and accurate and this should be checked by the employer.

12. Data Management

12.1 Each employer is responsible for ensuring any processing of personal data complies with the relevant General Data Protection Regulations (GDPR).

13. Resolution of issues

13.1 Enquiries can be made to the Scottish Government National Qualifications team about this payment by emailing: teacherpayment400@gov.scot.

14. Payment Form Completion Guidance

14.1 Education authority schools, Independent schools and grant-aided schools should collect and retain lists of all eligible staff who receive the payment. This data will include the names, National Insurance number and the amount claimed for each individual.

14.2 This data will be kept in compliance with any obligations under the Data Protection Act 2018 and any other legal obligations on providers in relation to personal data or sharing and retaining information.

14.3 In submitting this form the employer is declaring that numbers have been calculated based upon the eligibility criteria detailed in the guidance and that any payment made will be used as intended; to pay current and former staff who meet the eligibility criteria detailed in the guidance.

15. Standard form of words for communication to staff

The following is provided as a draft form of words for employers to provide to existing and former staff regarding the one-off exceptional £400 payment.

One-off exceptional £400 payment for Teachers supporting the delivery of the Alternative Certification Model for National 5, Higher and Advanced Higher qualifications in 2020/2021

In acknowledgement of COVID-19 related disruption to young people’s education this academic year, examinations for National 5, Higher and Advanced Higher courses in 2021 were cancelled. Instead, this year’s National Qualifications will be

awarded based on teacher’s and lecturer’s judgement of evidence of each individual learner’s demonstrated attainment.

First Minister Nicola Sturgeon announced on 16 February 2021 a one-off exceptional £400 pro rata payment for teachers and lecturers involved in the assessment, marking and quality assurance of National 5, Higher and Advanced Highers in the absence of the 2021 examination diet.

The Scottish Ministers wish to recognise the additional work undertaken in relation to delivering the Alternative Certification Model for National 5, Higher and Advanced Higher qualifications in 2020/2021. The payment will be made following completion of teacher’s and lecturer’s work in relation to this.

Those who work full-time or part-time are eligible for the payment. This includes whether you have a permanent or temporary contract. So long as you were employed between 1 January 2021 and 3 September 2021 as a teacher and supported the delivery of the ACM.

Those who were shielding; on sick leave; on maternity, paternity, adoption leave; or furloughed are not precluded from qualifying for this payment if they have had a role in supporting the delivery of the ACM.

In most cases we will be able to make this payment to you through your normal payroll without any information from you.

If you have more than 1 employer, left your role, retired or receive benefits we may need to make a change to your payment.

Please read the information attached and notify us as soon as possible if we need to make a change to your payment. We need this information before [date] so that we request the correct amount from the Scottish Government to make the payment to our staff.

We can spread the payment to you over a period of up to 3 months if this reduces the impact it has on your benefits. You need to notify us by [date] if you want us to do this.

FURTHER INFORMATION FOR STAFF

I have more than one employer

This is a £400 pro rata payment and the maximum payable is £400. It is your responsibility to make sure that if you work for more than one employer, that you do not receive more than the maximum payable of £400 in total.

You should notify one of your employers and ask for your payment to be reduced or disregarded from that employer.

You should also notify your employer of any duplicate or excessive payments that you have received.

This is your responsibility. Failure to do so may mean having to pay back some or all of the payment you receive. If you do receive duplicate or excess payments and/or payments which you are not entitled to receive, you must also tell your employer promptly. Deliberate failure to do so, or deliberately failing to notify one of your employers, intending to receive more than which you are entitled, is fraud and will be taken very seriously. If you are in any doubt please seek advice from your employer.

I have left my employer

If you have moved to a new school or employer you should be mindful of the potential for a claim totally more than £400 to be submitted erroneously on your behalf and make contact with your former and current employer. If you have left or retired and want us to request a payment on your behalf you must tell us.

If you were employed at an education authority school, independent school or grantaided school between 1 January 2021 and 3 September 2021 and supported delivery of the ACM, but have since left or retired you are eligible. Payment will be processed as a payment after leaving with tax payable on the full amount and National Insurance payable using the weekly threshold as per Her Majesty’s Revenue and Customs (HMRC) guidelines. If this does result in an overpayment of tax it is your responsibility to claim this back from HMRC.

Payments cannot be made to staff who were dismissed for gross misconduct.

State Benefits or Tax Credits

If you are in receipt of benefits you should get advice about what impact the payment may have on your benefits.

If you receive Universal Credit

If you receive Universal Credit you need to notify your work coach of the change in circumstances in order to avoid any overpayments which may result in issues with your payment.

The Department for Work and Pensions (DWP) will be automatically alerted if you if

you receive a payment from your employer alongside your salary.

You should get advice as soon as possible before receiving the payment.

It may also affect any benefits that you are entitled to as a result of receiving Universal Credit, such as Scottish Child Payment, Best Start Grant and Funeral Support Payment.

If you receive Tax Credits

The payment will be treated by HMRC as earnings for the tax year 2020/21 and might affect the amount of your tax credits award.

You should get advice as soon as possible before receiving the payment.

If you are receiving Legacy Benefits other than Tax Credits:

If you are receiving other ‘legacy benefits’ you should get advice as soon as possible before receiving the payment.

Legacy benefits are Housing Benefit (if you are under pension age), Income Support, income-based Jobseeker’s Allowance, and income-related Employment and Support Allowance.

If you receive a Council Tax Reduction

If you currently receive a Council Tax Reduction, you should get advice as soon as possible before receiving the payment.

Other Benefits that may be affected

The following benefits may also be affected:

• Pension credit

• Carer’s allowance

If you want to find out more about how this payment may affect your benefits or tax

credits, then contact:

Citizens Advice: Bureaux | Citizens Advice Scotland (cas.org.uk)

HMRC: Contact HMRC – GOV.UK (www.gov.uk)

DWP: Contact Jobcentre Plus – GOV.UK (www.gov.uk)

You must be logged in to post a comment.