- Home

- /

- Employee Relations

- /

- Ill Health Retirement

The purpose of guidance is to provide managers with guidance on how to progress an ill health retirement recommendation from the Council’s occupational health provider.

This guidance only applies to employees who are members of the Local Government Pension Scheme (LGPS) who meet the eligibility criteria for ill health retirement.

It does not apply to teachers whose ill health retirement provisions, under the Scottish Teachers Pension Scheme/Scottish Teachers Superannuation Scheme, are administered by the Scottish Public Pensions Agency (SPPA). Please refer to the SPPA website for details – click here, or you can contact the SPPA on telephone number 01896-893000.

Managers must ensure that all sickness absences are managed in line with the Council’s existing policy on Supporting Attendance and Wellbeing and that appropriate early interventions are made.

1. Ill Health Retirement Overview

Ill health retirement should be a consideration where you have an employee off on sickness absence who appears to have no likelihood of a return to work. This will be determined by Occupational Health and an assessment by an independent medical adviser. The full Ill Health Retirement Guidance – Issue 13 is available.

2. Pension Regulations

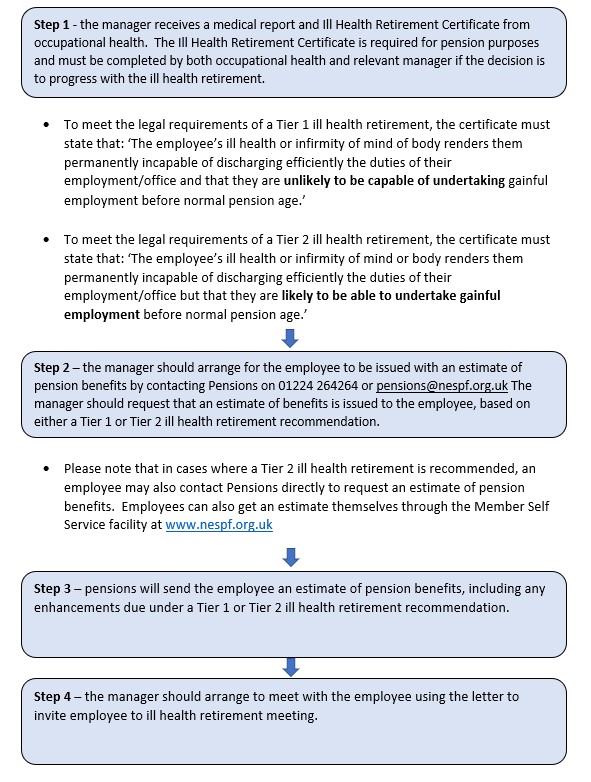

The introduction of the LGPS on 1 April 2009 brought in a two-tier ill health retirement provision for employees with at least 2 years’ membership of the pension scheme, who, on grounds of ill health of infirmity of mind or body, are permanently incapable of discharging efficiently the duties of their current employment. This has been maintained with the introduction of the LGPS Scotland regulations which came into force on 1 April 2015.

The two tiers are defined as below:

Tier 1 – applies where the member is unlikely to be capable of undertaking gainful employment* before normal pension age. Ill health retirement benefits will be paid to the employee immediately with an enhancement based on the member’s ‘Assumed Pensionable Pay’** (APP) and the years and days between the date of leaving and normal pension age, multiplied by 1/49th.

Tier 2 – applies where the member is likely to be able to undertake gainful employment* before normal pension age. Ill health retirement benefits will be paid immediately with an enhancement based on the member’s ‘Assumed Pensionable Pay’ (APP) and one quarter of the years and days between the date of leaving and normal pension age.

*Gainful employment is defined as paid employment for not less than 30 hours per week for a period of not less than 12 months.

**Assumed Pensionable Age is a notional pensionable pay figure that is used to ensure that your pension is not affected by any reduction to, or suspension of, your pensionable pay due to a period of sickness or injury, or any reduction due to relevant child related leave or reserve forces leave.

Before considering this provision, the Council’s occupational health provider must have provided a recommendation for ill health retirement by providing an Ill Health Retirement Certificate.

Notes –

(i) The Third Tier Ill Health Gratuity can apply to employees who are members of the Local Government Pension Scheme, who do not qualify for a Tier 1 or Tier 2 ill health retirement but for whom dismissal is contemplated due to long term sickness absence. Details are available from the Employee Relations Team in People and Organisational Development (contact employeerelations@aberdeencity.gov.uk)

(ii) It should be noted that the ill health retirement provisions and the Third Tier Ill Health Gratuity do not apply to those employees who are over their Normal Pension Age.

3. The Process

An electronic version of the process is available here.

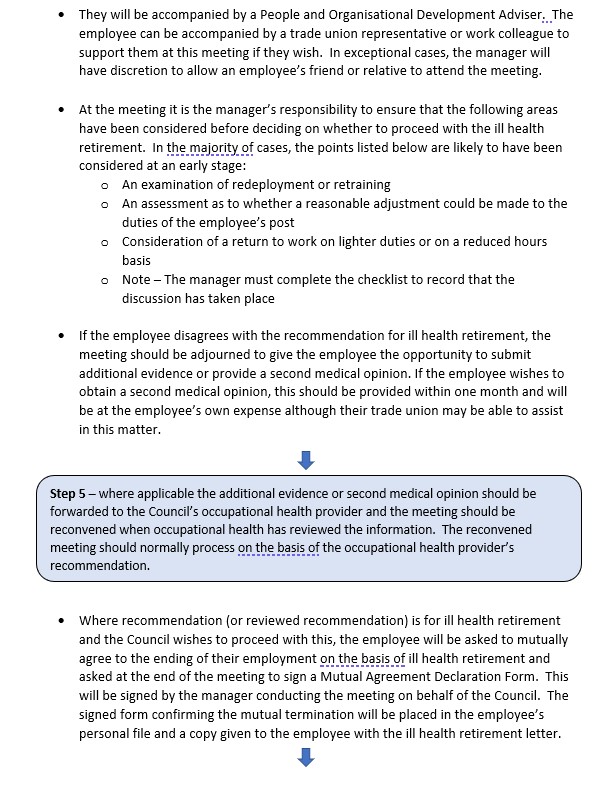

4. How to Conduct an Ill-health Retirement Meeting

Purpose and Structure

- Outline the purpose of the meeting i.e. to discuss the report from occupational health and determine whether the employee should be retired on grounds of ill health.

- Confirm the structure of the meeting i.e. to consider the medical advice, explore all reasonable options/alternatives and come to a decision regarding the recommendation for ill health retirement.

- Where the decision is to proceed with the ill health retirement, an explanation will follow on the arrangements for formal notification and payment of pension benefits.

Medical Report

- Discuss the main elements of the medical report and confirm that occupational health have recommended ill health retirement, either under Tier 1 or Tier 2. Explain the differences between the two tiers. At this point, it may be helpful to review the background to the case and consider any previous actions e.g. if a reasonable adjustment has been made and this has been unsuccessful.

Second Medical Opinion

- Confirm if the employee agrees that the medical report reflects their appointment with the occupational health. Advise that if they disagree, they have the right to request a second medical opinion (or provide additional medical evidence). This will be at their own expense, although financial assistance may be available from their trade union.

- If the employee disagrees with the recommendation from occupational health, the meeting should be adjourned and once the second medical opinion (or additional medical evidence) has been received, reconvened after occupational health have had the opportunity to review their recommendation, taking into account the new information provided.

Alternative Course of Action

- Ask if the employee can suggest an alternative course of action and record the outcome of this discussion. Consider whether any proposed course of action presents a realistic alternative to ill health retirement.

Decision

- If no alternative course of action is identified, confirm that the employee remains unfit for work and that no suitable alternative can be identified. Advise that ill-health retirement, under either Tier 1 or Tier 2, has been recommended by occupational health and accepted by the Council, with the employee asked to mutually agree to this.

Pension Benefits

- Check that the employee has received an estimate of pension benefits and answer any questions regarding payment arrangements, confirming that:

- Their pension will be paid on the 15th day of each month (if the 15th falls on weekend, payment will be made on the Friday immediately preceding this)

- Payment of the lump sum will be made by BACS following the final salary payment

- Note: Payment will usually be made within 4 weeks; however this is dependent on Pensions receiving the relevant paperwork within the required timescale. Pensions will aim to make payment within 10 working days of receiving all the information they need to process the final calculations

- Pension benefits for part-time employees are based on a proportion of full-time scheme membership and the full-time equivalent salary for the post for benefits up to 31 March 2015. Benefits accrued from 1 April 2015 will be calculated based on the 1/49th of pensionable pay (or assumed pensionable pay)

- The figures provided are only estimates and may change slightly at the date of payment once the employee’s final pay is confirmed by the payroll section

- Pensions will be able to provide answers to detailed questions. The Pensions helpdesk is available on 01224 264264 or by emailing pensions@nespf.org.uk. Alternatively, employees can speak to a Pensions Officer. The North-East Scotland Pension Fund are located at: Level 1, 2MSq, Marischal Square, Broad Street, Aberdeen, AB10 1BL.

End Date

- Confirm the end date of the employee’s contract which will normally be the date of the ill health retirement meeting or a date soon after, as agreed between the manager and employee.

Payment of Pension/Outstanding Holidays

- Explain that the service will notify Pensions to arrange payment of their pension benefits. Payroll will arrange all other payments including payment for any outstanding holidays (subject to any abatement).

Benefits

- Advise that the employee should contact Jobcentreplus to check their eligibility for government benefits. The Council will issue them with a SSP1 form, assuming the employee was in receipt of SSP and has not already been issued with one.

Formal Notification

- Advise that the outcome of the meeting will be followed up in writing. This letter will cover the main points of the meeting and will confirm that the ill health retirement is by mutual consent.

Close

- Check if the employee has any questions and thank them for their efforts and service to the Council.

5. General Information

ADDITIONAL VOLUNTARY CONTRIBUTIONS (AVCs)

If the employee is making additional voluntary contributions, the fund value from the AVC will be included within the initial ill health retirement pension scheme benefits estimate on the assumption that it will be paid as tax free cash. The pension options issued on confirmation of the ill health retiral will show the relevant options available in the respect of the AVC fund.

EMPLOYEE ASSISTANCE PROGRAMME

If an employee wishes to discuss any personal issues, they can contact the Employee Assistance Programme on 0800 970 3980 (free phone from a landline) or email admin@timefortalking.co.uk or via the website

HOLIDAY ENTITLEMENT

An employee who retires without returning to work following sickness absence will receive payment in lieu of holidays; subject to any reduction under the Council’s abatement provisions (see the Guidance on Abatement of Leave for further information).

BENEFITS

Payroll will complete an SSP1 form for government benefits, assuming the employee was in receipt of SSP and has not already been issued with one and send this to the employee. Further information on entitlements can be obtained from Jobcentreplus or by calling 0800 0556688. Please note that Jobcentreplus can only arrange home visits in exceptional circumstances.

RECLAIM OF MONIES (CAR LOANS, COLLEGE FEES ETC.)

Payroll will raise an invoice for any outstanding amounts and send this to the individual for payment.

EMPLOYEES WITH LESS THAN 2 YEARS’ SERVICE IN PENSION SCHEME

An employee who has less than two years’ membership in the pension scheme; who has not transferred in any previous benefits and who does not have any other deferred benefits in the pension scheme, will receive a refund of contributions. The pension forms noted below are not required and Pensions will treat the employee as a normal leaver.

EXPIRY OF SICK PAY

No pension contributions will be made to the pension scheme once an employee’s sick pay expires, however they will continue to receive credit for service up to the end date of their employment.

PENSION FORMS

Once Pensions have been informed of the ill health retirement and, provided the employee is entitled to an annual pension, they will send the employee:

- Bank mandate form

- To enable Pensions to pay pension benefits into the employee’s bank account.

- Marital Status form

- To obtain personal details from the employee. Employees’ birth certificate and, if applicable, spouses’ birth certificate and marriage certificate must also be forwarded (copies are acceptable).

- Option to commute pension for lump sum

- The employee has the option of giving up part pension for lump sum of their pension for an increased lump sum. The employee is informed of their commutation options by Pensions once they have been notified of the ill health retirement.

- Member declaration form

- Details of other pensions are required for the calculation of the Lifetime Allowance.

- Option to commute

- In cases of short life expectancy, the employee will be given the option to commute. The Ill Health Retirement Certificate must be completed to show that the employee has been fully informed of the situation.

Relevant Documents, Links and Letters

- Ill Health – Alternative Courses of Action Checklist

- Invite Letter to Ill Health Meeting

- Ill Health – Mutual Agreement Declaration Form

- Ill Health – Mutual Consent Letter

- Occupational Health Page

- Ill Health Retirement Guidance – Issue 13

- Pensions

- Time for Talking

- Pen 3.1 Form (This form can be found by following the link to the NESPF Page)

Click here to return to the main Employee Relations page

Add a ‘Like’ and/or a ‘Rating’ below to indicate how useful you found this page

You must be logged in to post a comment.